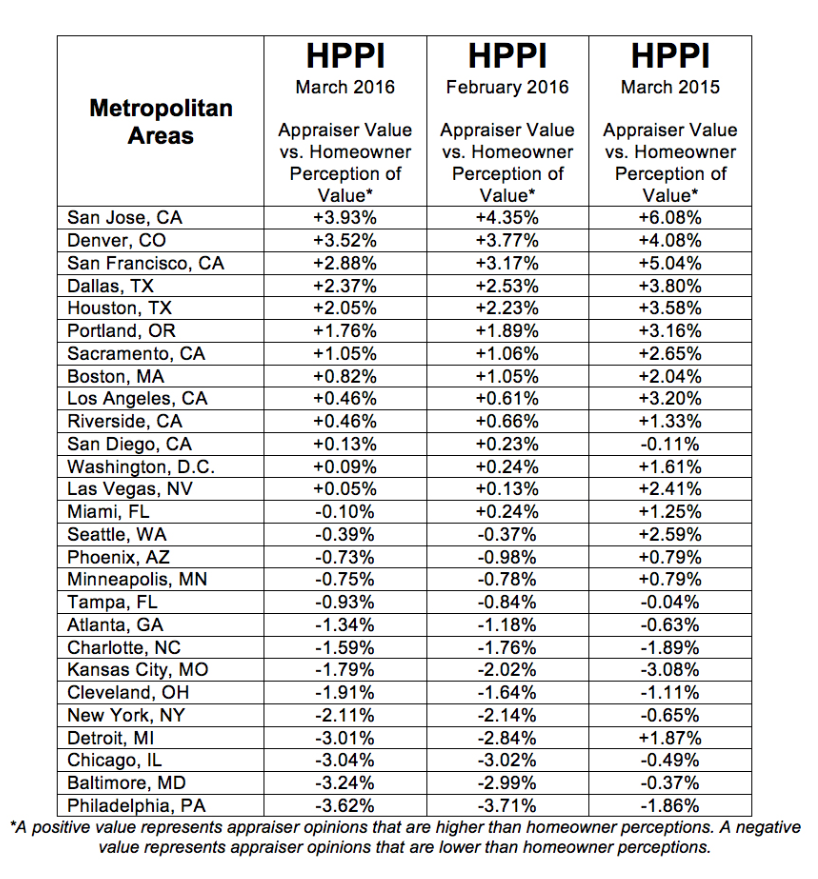

DAILY REAL ESTATE NEWS | THURSDAY, APRIL 14, 2016 Home owners may be slightly too optimistic about their home’s value compared to what appraisers say it’s actually worth. Home values are, on average, about 2.17 percent lower than what home owners expect compared to appraisers’ estimates, according to Quicken Loans’ latest Home Price Perception Index. The gap between home owner expectations and appraisal estimates widened in March. In February, appraisals were 1.99 percent lower than what home owners expected. Several areas in the Western region of the U.S., however, continue to see that the average appraised value is beyond what home owners were expecting. On the other hand, in the Midwest, appraisals tended to lag behind home owner estimates. “The varying HPPI values across the country illustrates the importance of examining the market at the local level,” says Quicken Loans Chief Economist Bob Walters. “If home owners are eyeing that new home being built across town, they could be pleasantly surprised how much their home will sell for – or in some instances their equity may not take them as far as they think – depending on what area of the country they’re in. … It’s not always easy for home owners to keep their finger on the pulse of their equity.” View a chart to see the breakdown of appraisal values versus home owners’ perceptions of value by metro level

(703) 913-1300